Essentially, you won’t want to pull out one the fresh new loans when you are in the process of closing a mortgage loan. So, when Might you Get a personal bank loan Shortly after To acquire property?

Together with, after you have finalized to your that loan, you actually need certainly to hold off three to six weeks prior to taking out a personal loan.

Personal loans they can be handy for residents, and there is no certified laws that you cannot sign up for one to while you are interested in a property.

- Your credit rating takes a bump and apply at your loan cost

- Your debt-to-money ratio could possibly get increase and you can connect with the home loan qualification

- While you are already coping with a mortgage lender, they are informed to your financing craft

- You may also feeling their mortgage loan qualifications regardless if you already been cleaned to close

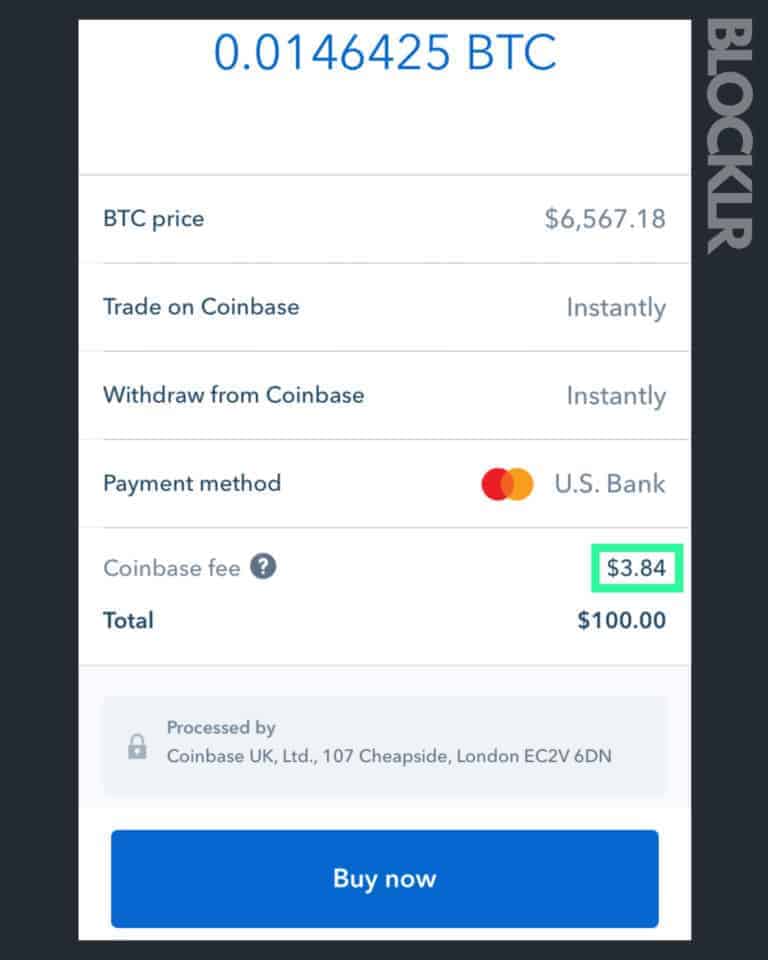

When you find yourself still being unsure of out of if or not you really need to sign up for good unsecured loan when selecting a house, here’s an enthusiastic infographic that will help you know:

If you get an unsecured loan When buying property? Do’s and you may Don’ts

- Strive to remove a personal loan to fund brand new down payment.

- Propose to acquire to cover settlement costs, inspections, moving costs, an such like. having a personal bank loan.

- Take-out financing at all if you intend to put on to possess a home loan in the future, generally speaking.

- Just be sure to cover-up unsecured loan hobby out-of loan providers.

- Play with a consumer loan to possess expenditures like furniture, solutions, home improvements, and you may non-financial expenditures really once you have currently settled on your own new home.

Expenses related to the latest sale-such as for instance appraisals, inspections, and you may off money-are best paid for having dollars otherwise away from currency lent in person regarding home loan company.

Remember that that it pertains to more than just signature loans. Also borrowing off friends can sometimes provides unexpected outcomes. Since commonly, mortgage gurus comment debt interest observe just how long you have got your money. One abrupt large increases might have to feel told the new prospective mortgagor, that may harm your chances so you can qualify for home financing.

Assist! I bought a house and today I am Domestic Bad

If your home loan repayments is actually using up a great deal more compared to the recommended twenty-five% of your just take-family shell out, you may end up being economically restricted, aka family bad.

This is certainly a tricky disease to cope with. Listed below are some suggestions while you are facing a casing-related financial crisis:

When in Doubt, Ask your Financial Administrator

Unsecured loans will come inside the handy for home owners looking to improvements or solutions. However they would be challenging to utilize close to domestic-to buy date.

In any case, you can always inquire the brand new representative you’re handling when the providing aside an unsecured loan can be helpful. Each mortgagor is different and more than have to help you has actually a successful homebuying sense, therefore it is essentially beneficial to have confidence in the guidelines.

Everything in this post is actually for general informational motives just. Republic Loans will not make any guarantees or representations of every type, share otherwise designed, depending on the pointers considering within article, such as the precision, completeness, physical fitness, versatility, access, adequacy, otherwise precision of your own suggestions within this article. What contains herein isnt intended to be and you may do maybe not form economic, court, income tax and other advice. Republic Finance has no accountability for your errors, omissions, or inaccuracies throughout the information or any liability arising from one dependency apply eg recommendations from you otherwise anybody who could possibly get feel informed of suggestions in this post. One reliance you add towards the information inside blog post is exactly at your very own chance. Republic Finance will get reference third parties contained in this post. A 3rd-class reference will not make up sponsorship, association, connection, or approval of this 3rd party. Any third-team trademarks referenced are definitely the possessions installment loans for bad credit Blue Springs of the respective people. Your use and use of this website, web site, and you can any Republic Money web site or cellular software program is at the mercy of our very own Terms of service, readily available here.